In 2024, payroll software for accountants has evolved to meet the complex and diverse needs of modern accounting practices. With the integration of advanced features such as automation, compliance management, and data analytics, these tools have become indispensable for accountants seeking efficiency and accuracy. Below, we have guided you into the best payroll software options for accountants, providing comprehensive features, benefits, and suitability for various accounting needs.

What is Payroll Software?

Payroll software serves as a specialized tool crafted to enhance efficiency by automating the process of compensating employees within a company. It encompasses various functionalities that handle all aspects of payroll management, ensuring that employees are paid accurately and on time while complying with all relevant legal and tax requirements.

Why Payroll Software is Essential for Accountants

Payroll software is essential for businesses to accurately calculate and manage employee salaries, taxes, and deductions, ensuring compliance with legal and regulatory requirements, while also streamlining the payroll process for efficiency and accuracy.

Streamlining Payroll Processes

Payroll software simplifies the payroll process by automating tasks such as salary calculations, tax withholdings, and direct deposits. This automation reduces the likelihood of errors and saves significant time. For example, Gusto, a popular payroll software, offers automated payroll processing that ensures employees are paid accurately and on time.

Ensuring Compliance

Keeping up with the constantly evolving tax laws and regulations can prove to be a daunting task. Payroll software keeps accountants updated with the latest compliance requirements, automatically adjusting payroll calculations to meet legal standards. For instance, ADP’s payroll solutions include features for managing compliance with federal, state, and local payroll regulations.

Enhancing Data Security

Handling sensitive employee information requires robust security measures. Payroll software provides encrypted data storage and secure access controls to protect against data breaches. Paychex, for example, employs advanced security protocols to safeguard payroll data, ensuring confidentiality and integrity.

Benefits of Payroll Software

- Time Savings: By automating repetitive tasks, payroll software saves significant time for HR and accounting departments, allowing them to focus on more strategic activities.

- Accuracy: Automation reduces the risk of errors in payroll processing, ensuring that employees are paid correctly and on time.

- Compliance: Payroll software helps businesses comply with complex tax laws and labor regulations, reducing the risk of penalties and audits.

- Employee Satisfaction: Accurate and timely payment, combined with easy access to payroll information, enhances employee satisfaction and trust in the company.

- Cost Efficiency: While there is an upfront cost associated with payroll software, the long-term savings from reduced errors, compliance issues, and administrative burdens make it a cost-effective solution.

Top Payroll Software for Accountants in 2024

Here we provide you with some popular payroll software with their key features.

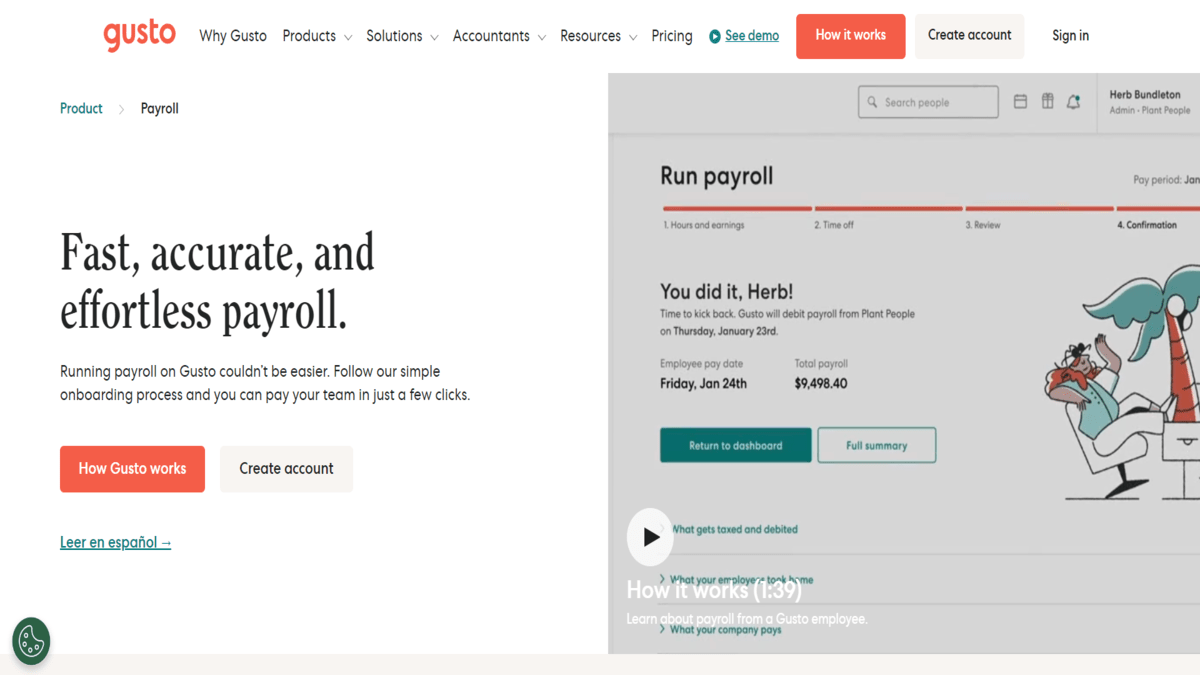

Gusto Payroll Software

Gusto stands out as a favored choice among businesses, offering a payroll software solution that effectively simplifies payroll operations, catering to enterprises of varying sizes.With its user-friendly interface and robust feature set, Gusto is particularly well-suited for small to medium-sized businesses looking to simplify payroll management, ensure compliance, and enhance overall HR operations.

Key Features

- Automated Payroll Processing: Gusto automates the entire payroll process, from calculating salaries to filing taxes.

- Employee Self-Service Portal: Employees can access their pay stubs, tax forms, and benefits information online.

- Integration with Accounting Software: Gusto integrates seamlessly with accounting tools like QuickBooks and Xero.

Example Use Case

A small accounting firm uses Gusto to manage payroll for multiple clients. The software’s automated features reduce manual data entry and ensure timely payroll processing, allowing the firm to focus on providing strategic financial advice.

ADP Payroll Software

ADP (Automatic Data Processing) is a well-known payroll software solution that helps businesses manage their payroll processes efficiently. Suitable for companies of all sizes, ADP offers a range of features designed to simplify payroll management and ensure compliance with tax laws and regulations.

Key Features

- Comprehensive Compliance Management: ADP keeps track of regulatory changes and ensures payroll processes adhere to all legal requirements.

- Advanced Reporting and Analytics: ADP offers detailed reports and analytics to help accountants monitor payroll expenses and trends.

-

Scalability: From small startups to large enterprises, it caters to businesses of all sizes.

Example Use Case

A mid-sized business with a growing workforce uses ADP to manage payroll. The software’s compliance features prevent costly mistakes and penalties, while the advanced analytics provide valuable insights into payroll expenses.

Paychex Payroll Software

Paychex is a popular payroll software solution designed to help businesses manage their payroll and HR processes easily and efficiently. It is especially suitable for small to medium-sized businesses, providing a range of features that simplify payroll management, ensure compliance, and support overall HR functions.

Key Features

- Customizable Payroll Solutions: Paychex offers tailored payroll solutions to meet the specific needs of different businesses.

- 24/7 Customer Support: Paychex provides round-the-clock support to assist with any payroll-related issues.

- Robust Security Features: Ensures the security and privacy of payroll data through encryption and secure access controls.

Example Use Case

An accounting firm specializing in various industries uses Paychex to handle payroll for clients with unique needs. The customizable features allow the firm to provide personalized payroll solutions, enhancing client satisfaction.

QuickBooks Payroll

QuickBooks Payroll is a user-friendly payroll software designed by Intuit, aimed at helping small to medium-sized businesses manage their payroll processes easily and accurately. Integrated with QuickBooks accounting software, it offers a comprehensive solution for handling payroll and financial management in one place.

Key Features

- Seamless Integration with QuickBooks: QuickBooks Payroll integrates effortlessly with QuickBooks accounting software, streamlining financial management.

- Automated Tax Calculations and Filings: Automatically calculates and files federal and state payroll taxes.

- Employee Benefits Management: Manages employee benefits such as health insurance and retirement plans.

Example Use Case

A freelance accountant uses QuickBooks Payroll to manage payroll for several small business clients. The integration with QuickBooks simplifies bookkeeping and ensures accurate financial records, saving time and reducing errors.

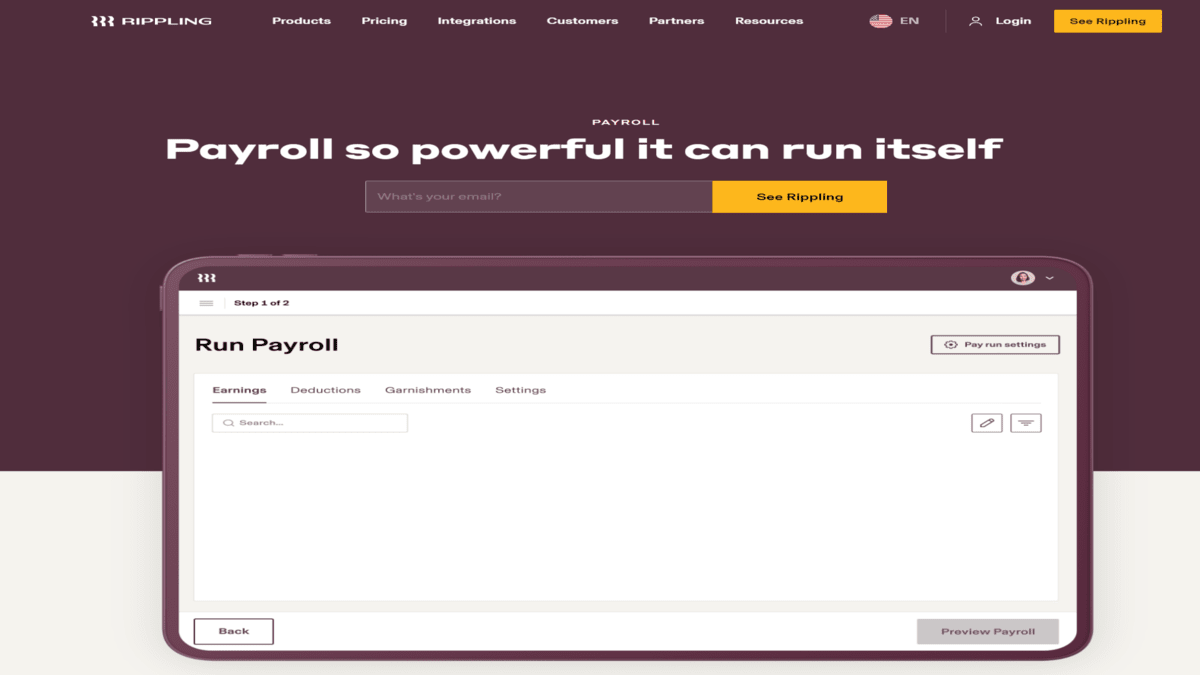

Rippling Payroll Software

Rippling presents a comprehensive cloud-based platform for payroll and HR management, meticulously crafted to streamline the intricacies of employee administration.It integrates payroll, benefits, HR, and IT into a single system,making workforce management more efficient and straightforward for businesses.

Key Features

- Automated Payroll Processing: Automatically calculates payroll, deductions, and taxes.Manages the intricate process of filing and paying federal, state, and local taxes.

- Supports direct deposit and multiple payment methods.

- Employee Self-Service: Provides a portal for employees to access pay stubs, W-2s, and update personal information. Allows employees to manage their benefits and time off requests.

- Time and Attendance Tracking: Integrates with time tracking tools to accurately calculate hours worked. Supports clock-in/clock-out functionality and manages overtime.

Example Use Case

Rippling streamlines payroll calculations and tax filings, enhancing efficiency and minimizing potential errors, while also saving valuable time. Easily manage benefits and time off requests for a growing team, ensuring compliance and employee satisfaction. Manually process payroll for 10 employees using spreadsheets.

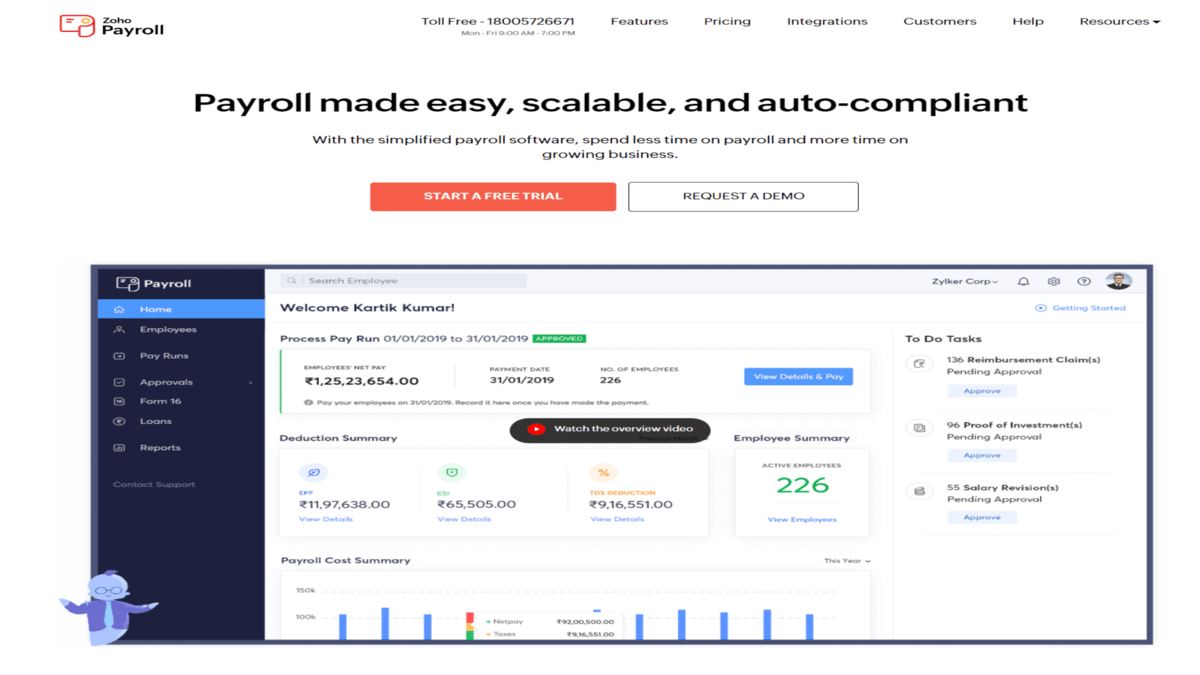

Zoho Payroll Software

Zoho Payroll is a tool that helps businesses handle paying their employees. It determines employees’ pay, deducts taxes and other contributions, and creates detailed pay slips. It also helps with keeping track of rules and regulations related to paying employees. Zoho Payroll makes managing payroll faster, more accurate, and less prone to mistakes.

Key Features

- Automated Payroll Processing: Zoho Payroll automates the calculation of employee salaries, taxes, and deductions. This saves time and reduces the risk of errors compared to manual calculations.

- Compliance Management: The software helps businesses stay compliant with payroll-related regulations and tax laws. It keeps track of changes in regulations and ensures that payroll processes adhere to them.

- Employee Self-Service: Zoho Payroll provides employees with self-service options to access their pay stubs, tax forms, and other payroll-related information. This lightens the load on HR staff while enabling employees to handle their own payroll details independently.

Example Use Case

Zoho Payroll helps you easily calculate how much to pay each employee based on their salary or hourly rate and the hours they’ve worked. The software automatically deducts taxes, insurance premiums, and other deductions from employees’ paychecks, ensuring accuracy and compliance with regulations.

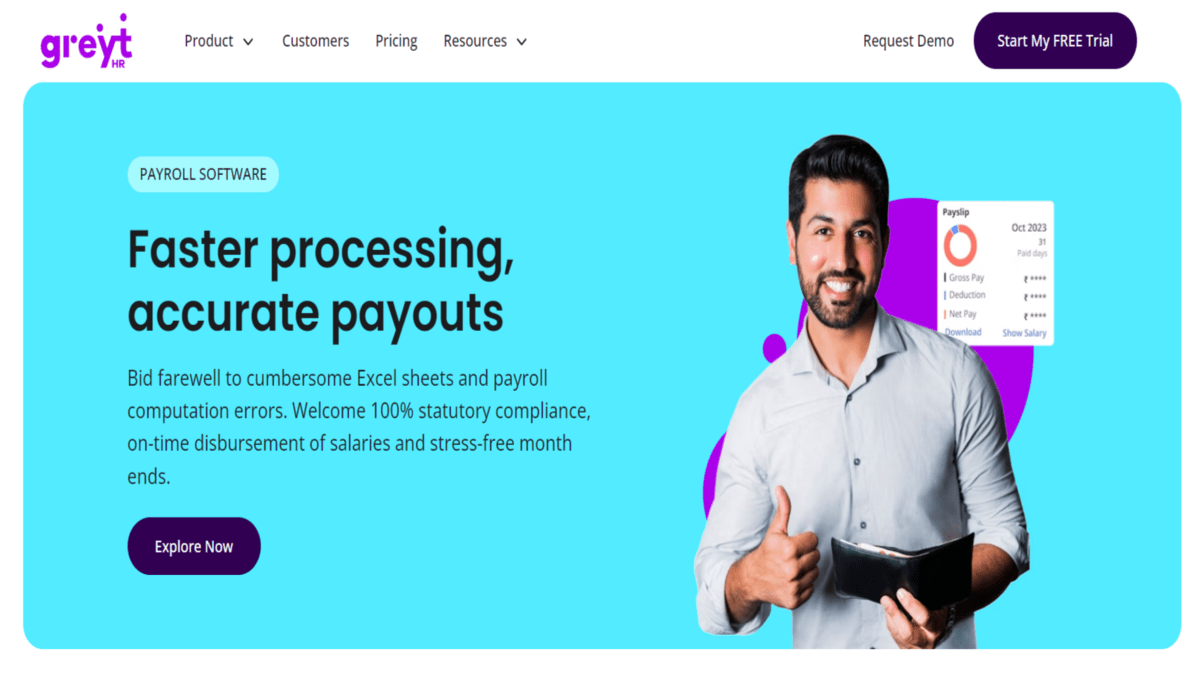

GreyHR Payroll Software

GreytHR is a cloud-based HR and payroll software specifically tailored for small and medium-sized businesses in India. It offers a range of features to help businesses manage their HR and payroll processes, including payroll management, attendance tracking, leave management, and compliance management.

Key Features

- Payroll Processing: Automates payroll calculations, including taxes, deductions, and reimbursements.

- Employee Self-Service: Allows employees to access their pay slips, apply for leave, and update personal information.

- Attendance Management: Tracks employee attendance, including late arrivals, early departures, and absences.

- Leave Management: Manages employee leave requests, balances, and approvals.

Example Use Case

GreytHR helps the tech startup manage its payroll and HR processes more efficiently, allowing the company to focus on its core business activities and growth.

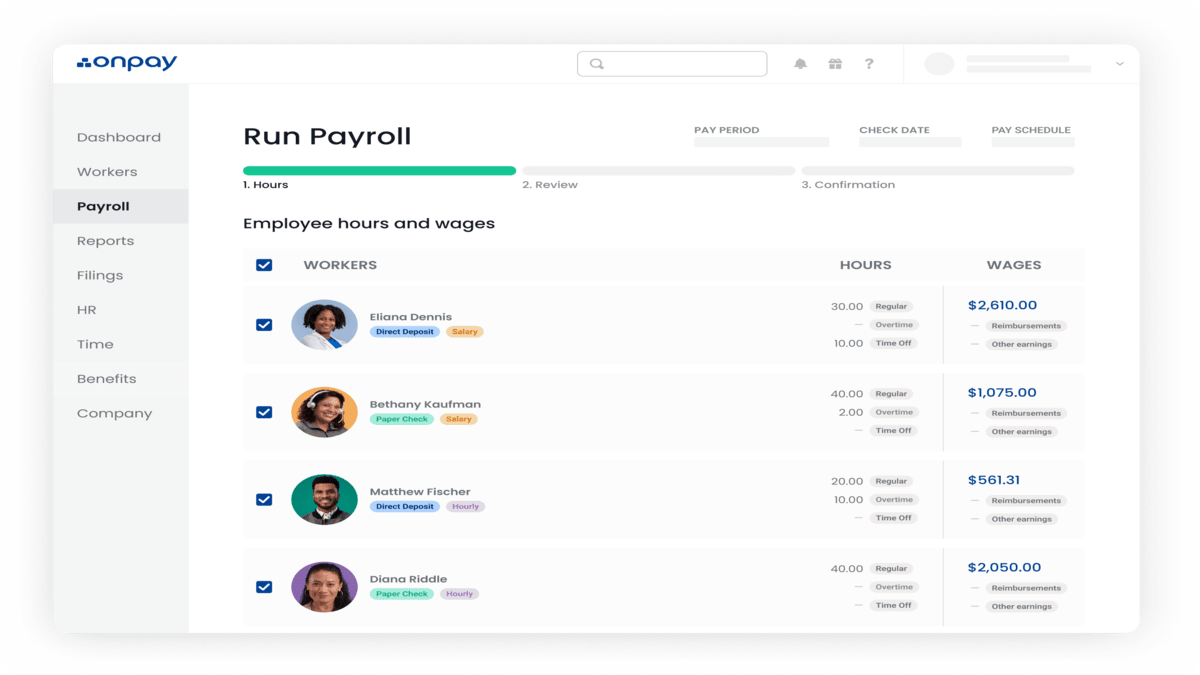

Onpay Payroll Software

OnPay is a cloud-based payroll software designed for small businesses. It offers features such as automated payroll processing, tax calculations and filing, direct deposits, and employee self-service. OnPay aims to simplify payroll management for small businesses by offering a user-friendly interface and comprehensive support.

Key Features

- Automated Payroll Processing: OnPay automates the process of calculating employee wages, taxes, and deductions. This helps businesses save time and reduce errors compared to manual calculations.

- Tax Compliance: OnPay helps businesses stay compliant with tax laws and regulations by calculating and withholding the correct amount of taxes from employee paychecks. It also helps with filing tax forms and reports.

- Employee Self-Service: OnPay provides employees with self-service options to view their pay stubs, tax forms, and other payroll-related information. This eases the workload on HR staff and empowers employees to manage their own payroll information independently.

Example Use Case

A small business owner uses OnPay to manage their payroll process. They input employee hours and pay rates into the software, and OnPay calculates the wages, taxes, and deductions for each employee. It also helps the business file their payroll taxes accurately and on time.

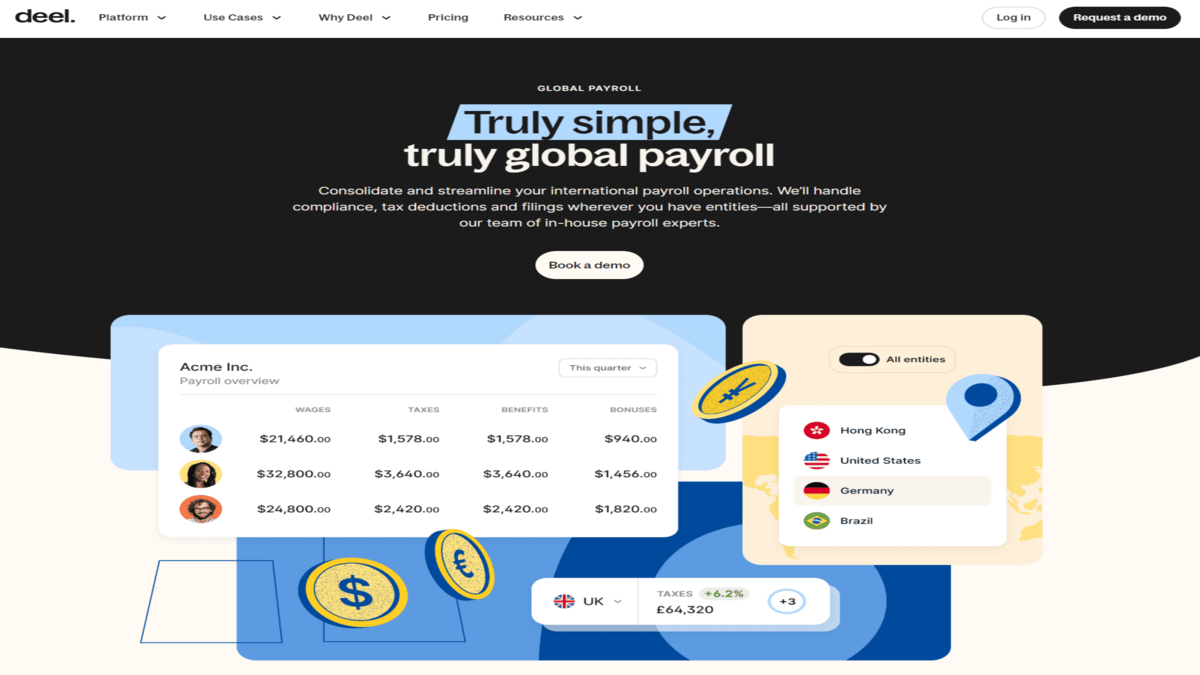

Deel Payroll Software

Deel is a global platform for payroll and compliance, designed specifically for remote teams. It helps businesses manage international payroll, compliance, and taxes for remote workers in over 150 countries. Deel offers features like automated payments, contract creation, tax calculations, and compliance support, making it easier for businesses to manage their global workforce.

Key Features

- Global Payroll Management: Deel allows businesses to manage payroll for their international team members, handling everything from payment processing to compliance with local tax laws and regulations.

- Contract Management: The platform helps create and manage employment contracts and agreements tailored to the requirements of different countries, ensuring legal compliance and clarity for both employers and employees.

- Compliance Assistance: Deel provides guidance and support for navigating the complex landscape of international labor laws and regulations, helping businesses stay compliant with local requirements related to payroll, taxes, and employment.

Example Use Case

Deel can automate payments to remote workers in their local currencies, reducing the administrative burden on the company.Deel can help create and manage employment contracts for remote workers, ensuring that all parties are clear about their rights and responsibilities.

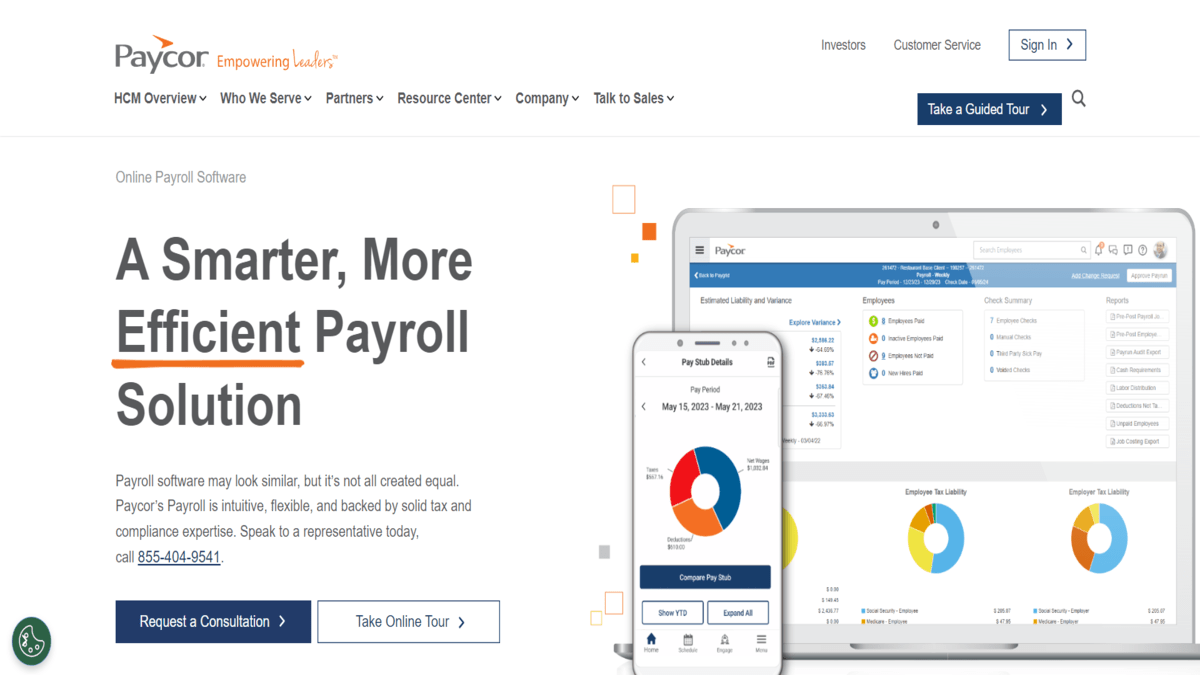

Paycor Payroll Software

Paycor is a cloud-based software designed for small to medium-sized businesses to manage payroll and HR tasks. It helps streamline payroll, automate tax filing, and ensure compliance with regulations. Key features include employee self-service, time tracking, and reporting. Overall, Paycor streamlines payroll and HR processes, saving time and minimizing errors.

Key Features

- Automated Payroll Processing: Paycor simplifies payroll by automating calculations, deductions, and tax filings, ensuring accuracy and compliance with state and federal regulations.

- Employee Self-Service: Employees can access their payroll information, view pay stubs, and manage personal details through an intuitive self-service portal, reducing the administrative burden on HR.

- Time and Attendance Tracking: Integrated time tracking features allow businesses to monitor employee hours, manage attendance, and ensure accurate payroll processing based on actual work hours.

Example Use Case

This can be time-consuming and error-prone, resulting in payroll discrepancies and employee dissatisfaction. Managing varied employee shifts and ensuring accurate time tracking across different locations. Navigating state and federal labor laws and tax regulations, especially with employees in multiple states.

Choosing the Right Payroll Software for Your Practice

Assess Your Needs

Before selecting payroll software, assess your accounting practice’s specific needs.Consider factors like the size of your client base, the complexity of payroll requirements, and your budget.

Compare Features and Pricing

Compare the features and pricing of different payroll software options. Look for software that offers the functionality you need at a price that fits your budget.Many providers offer tiered pricing plans to cater to different business sizes and needs.

Evaluate Integration Capabilities

Ensure that the payroll software integrates with your existing accounting tools. Integration reduces manual data entry, minimizes errors, and enhances overall efficiency.

Consider Customer Support

Having reliable customer support is crucial for quickly and efficiently resolving issues. Choose payroll software that offers robust customer support, including live chat, phone support, and online resources.

Conclusion

In 2024, the best payroll software for accountants will combine automation, compliance management, data security, and integration capabilities to streamline payroll processes and enhance efficiency. Whether you choose Gusto, ADP, Paychex, or QuickBooks Payroll, these tools will empower your accounting practice to deliver accurate and timely payroll services, ultimately driving client satisfaction and business growth. By carefully assessing your needs and comparing features, you can select the payroll software that best aligns with your practice’s requirements.

FAQ

Q:1: What are the top features to look for in payroll software for accountants?

Ans: Look for software that offers automated payroll processing, tax calculations, compliance management, reporting, and integration with accounting systems.

Q:2: Which payroll software is best for small businesses?

Ans: Paychex, Gusto, and QuickBooks Payroll are popular choices for small businesses due to their affordability and ease of use.

Q:3: What is the best payroll software for large enterprises?

Ans: ADP Workforce Now, Paycom, and Workday are widely used by large enterprises for their advanced features and scalability.

Q:4: How do I choose the right payroll software for my accounting firm?

Ans: Consider factors such as your firm’s size, budget, specific payroll needs, integration capabilities, and customer support when choosing payroll software.

Q:5: What are the key benefits of using payroll software for accountants?

Ans: Payroll software helps accountants streamline payroll processing, reduce errors, ensure compliance, and save time on administrative tasks.

Q:6: Can payroll software handle multi-state payroll and compliance?

Ans: Yes, many payroll software solutions are equipped to handle multi-state payroll processing and compliance with state and federal regulations.

Q:7: How does payroll software integrate with accounting systems?

Ans: Payroll software can integrate with accounting systems through APIs or direct integrations, allowing for seamless data transfer between the two systems.

Q:8: Is cloud-based payroll software secure for storing sensitive payroll data?

Ans: Yes, reputable cloud-based payroll software providers use encryption and other security measures to protect sensitive payroll data.

Q:9: Can payroll software help with tracking employee hours and overtime?

Ans: Yes, many payroll software solutions offer time tracking features to help track employee hours, calculate overtime, and ensure accurate payroll processing.

Q:10: How much does payroll software typically cost for accountants?

Ans: The cost of payroll software varies depending on the provider, features included, and the number of employees. Generally, prices range from $20 to $200 per month.

Read More: How to Use Social Media for Marketing